I’ve seen 54 out of the 100 films on AFI’s list of all-time greatest American films. Of the ones I’ve missed, there are a few I do genuinely want to see. But will my life or career be negatively impacted if I never see Intolerance (1916)? I doubt it.

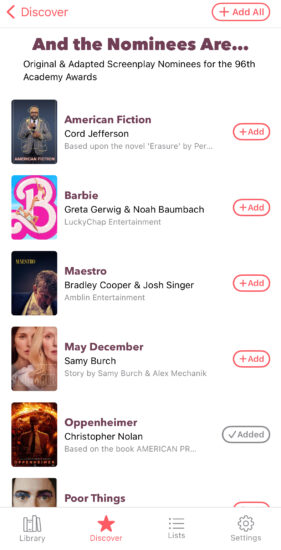

In episode 637 of Scriptnotes, Craig and I discuss which movies screenwriters “should” see. That is, of all the movies out there, which ones are most likely to come up in meetings, or be relevant to projects we’re writing in the 2020s?

Inevitably, one’s viewing is going to be greatly affected by when you were born. Craig and I were both born in the 1970s. Is it realistic or necessary for a screenwriter born in 2000 to have the same breadth of 1980s cinematic knowledge?

Preparing for the segment, Scriptnotes producer Drew Marquardt and I went through online lists of the 100 best movies for past four decades. Some of the lists were from Rolling Stone, others from IMDb.1 Drew and I marked which films we’ve never seen.

Key: John hasn’t seen | Drew hasn’t seen

Movies of the 1980s

- Do the Right Thing

- Videodrome

- Raging Bull

- Blue Velvet

- Ran

- Shoah

- Blade Runner

- Stranger Than Paradise

- The Thin Blue Line

- Raiders of the Lost Ark

- Sex, Lies, and Videotape

- Come and See

- The Thing

- Brazil

- Die Hard

- The Shining

- Raising Arizona

- Say Anything

- Something Wild

- Blow Out

- Stop Making Sense

- An American Werewolf in London

- The Right Stuff

- Paris, Texas

- RoboCop

- The King of Comedy

- E.T.

- The Terminator

- This Is Spinal Tap

- Elephant

- Repo Man

- Fast Times at Ridgemont High

- They Live

- Wings of Desire

- Risky Business

- Fanny and Alexander

- Star Wars: Episode V – The Empire Strikes Back

- The Elephant Man

- My Neighbor Totoro

- Reds

- The Decalogue

- Pee-wee’s Big Adventure

- The Times of Harvey Milk

- Mad Max 2

- After Hours

- Once Upon a Time in America

- The Blues Brothers

- She’s Gotta Have It

- Koyaanisqatsi

- Fitzcarraldo

- Aliens

- Thief

- Sophie’s Choice

- Roger & Me

- My Beautiful Laundrette

- Big

- Modern Romance

- Purple Rain

- My Dinner with Andre

- Bull Durham

- Cutter’s Way

- Evil Dead II

- Broadcast News

- Akira

- Back to the Future

- The Long Good Friday

- Desperately Seeking Susan

- Blood Simple

- Caddyshack

- The Killer

- Possession

- 48 Hrs.

- Ghostbusters

- Drugstore Cowboy

- Vagabond

- Heathers

- Women on the Verge of a Nervous Breakdown

- Police Story

- Full Metal Jacket

- Sweetie

- River’s Edge

- Hollywood Shuffle

- The Little Mermaid

- Midnight Run

- Bill & Ted’s Excellent Adventure

- Withnail & I

- Atlantic City

- The Brother from Another Planet

- Amadeus

- The Cook, the Thief, His Wife & Her Lover

- The Vanishing

- Airplane!

- Near Dark

- Who Framed Roger Rabbit

- Matewan

- Scarface

- Miracle Mile

- The Decline of Western Civilization

- Gregory’s Girl

- Testament

Movies of the 1990s

- Pulp Fiction

- Goodfellas

- Fargo

- L.A. Confidential

- The Big Lebowski

- Saving Private Ryan

- Fight Club

- The Silence of the Lambs

- Magnolia

- American Beauty

- Unforgiven

- Se7en

- The Shawshank Redemption

- Forrest Gump

- Heat

- Sling Blade

- Out of Sight

- Dazed and Confused

- American History X

- Election

- Miller’s Crossing

- Boogie Nights

- Groundhog Day

- Schindler’s List

- Good Will Hunting

- True Romance

- The Usual Suspects

- Being John Malkovich

- Rushmore

- Reservoir Dogs

- Braveheart

- JFK

- Ed Wood

- Waiting for Guffman

- Dances with Wolves

- Kingpin

- Dumb and Dumber

- Clerks

- Mallrats

- Jackie Brown

- Boyz n the Hood

- Get Shorty

- Jerry Maguire

- Bottle Rocket

- Rounders

- The Matrix

- Malcolm X

- Quiz Show

- Titanic

- The Rainmaker

- Terminator 2: Judgment Day

- As Good as It Gets

- Barton Fink

- Toy Story

- Dead Man Walking

- Jurassic Park

- Dead Man

- Toy Story 2

- The Sixth Sense

- The English Patient

- Edward Scissorhands

- The Fugitive

- Donnie Brasco

- Three Kings

- The Thin Red Line

- Glengarry Glen Ross

- South Park: Bigger, Longer & Uncut

- The Green Mile

- Trainspotting

- Scent of a Woman

- In the Name of the Father

- Scream

- The Last of the Mohicans

- Leaving Las Vegas

- The Lion King

- Apollo 13

- Short Cuts

- Aladdin

- The Grifters

- Beauty and the Beast

- Philadelphia

- Wag the Dog

- Wayne’s World

- The Player

- My Cousin Vinny

- The Truman Show

- There’s Something About Mary

- Lock, Stock and Two Smoking Barrels

- Léon: The Professional

- Office Space

- Thelma & Louise

- The Insider

- Nobody’s Fool

- Swingers

- A Few Good Men

- The People vs. Larry Flynt

- Chasing Amy

- Lone Star

- The Fisher King

- 12 Monkeys

Movies of the 2000s

- Gladiator

- The Dark Knight

- Slumdog Millionaire

- The Departed

- The Lord of the Rings: The Return of the King

- Pan’s Labyrinth

- Blood Diamond

- City of God

- Finding Nemo

- No Country for Old Men

- Cinderella Man

- V for Vendetta

- There Will Be Blood

- Donnie Darko

- Sin City

- Mystic River

- 300

- Let the Right One In

- A Beautiful Mind

- Munich

- Up

- Memento

- The Lord of the Rings: The Two Towers

- The Prestige

- WALL·E

- Requiem for a Dream

- Into the Wild

- The Pianist

- Inglourious Basterds

- The Lord of the Rings: The Fellowship of the Ring

- Lost in Translation

- The Hurt Locker

- Eternal Sunshine of the Spotless Mind

- Crouching Tiger, Hidden Dragon

- American Psycho

- Kill Bill: Vol. 1

- Road to Perdition

- Walk the Line

- The Last Samurai

- Million Dollar Baby

- O Brother, Where Art Thou?

- Downfall

- Black Hawk Down

- Hotel Rwanda

- The Curious Case of Benjamin Button

- Eastern Promises

- Little Miss Sunshine

- The Incredibles

- American Gangster

- Gran Torino

- Zombieland

- The Wrestler

- Big Fish

- Crazy Heart

- Doubt

- 28 Days Later

- Thank You for Smoking

- The Assassination of Jesse James by the Coward Robert Ford

- The Bourne Identity

- Taken

- Snatch

- Casino Royale

- The Bourne Ultimatum

- Almost Famous

- Letters from Iwo Jima

- Gangs of New York

- Children of Men

- The Pursuit of Happyness

- Tears of the Sun

- Avatar

- Collateral

- Batman Begins

- Kill Bill: Vol. 2

- The Aviator

- Saw

- Kung Fu Panda

- Ocean’s Eleven

- Superbad

- Man on Fire

- Minority Report

- Seven Pounds

- Traffic

- United 93

- The Bourne Supremacy

- Monsters, Inc.

- Shrek

- The Boy in the Striped Pajamas

- Catch Me If You Can

- Iron Man

- Cloudy with a Chance of Meatballs

- Training Day

- Sunshine

- 21 Grams

- 3:10 to Yuma

- District 9

- The Others

- Anchorman: The Legend of Ron Burgundy

- In Bruges

- Crash

- Shaun of the Dead

Movies of the 2010s

- Parasite

- Mad Max: Fury Road

- Django Unchained

- Three Billboards Outside Ebbing, Missouri

- La La Land

- Dunkirk

- Whiplash

- The Irishman

- Your Name.

- Avengers: Endgame

- Inception

- Spider-Man: Into the Spider-Verse

- Birdman or (The Unexpected Virtue of Ignorance)

- Blade Runner 2049

- 1917

- Avengers: Infinity War

- Locke

- Calvary

- The Hunt

- Interstellar

- Once Upon a Time… in Hollywood

- Guardians of the Galaxy

- The Hateful Eight

- Logan

- X-Men: Days of Future Past

- Captain America: Civil War

- Captain America: The Winter Soldier

- Rogue One: A Star Wars Story

- Inside Llewyn Davis

- Baby Driver

- Marriage Story

- The Social Network

- The Dark Knight Rises

- Her

- Manchester by the Sea

- Knives Out

- Confessions

- Arrival

- Gone Girl

- A Silent Voice: The Movie

- Ford v Ferrari

- A Quiet Place

- Nightcrawler

- Fruitvale Station

- Prisoners

- Skyfall

- Warrior

- Thor: Ragnarok

- The Avengers

- Joker

- Wind River

- Frank

- Green Book

- Deadpool

- Spider-Man: Far from Home

- Jojo Rabbit

- Guardians of the Galaxy Vol. 2

- Deadpool 2

- Nocturnal Animals

- Kick-Ass

- The Grand Budapest Hotel

- Gravity

- Room

- 12 Years a Slave

- Inside Out

- Toy Story 3

- Argo

- Moonrise Kingdom

- Moonlight

- Burning

- A Star Is Born

- The Great Beauty

- Harry Potter and the Deathly Hallows: Part 2

- 13 Assassins

- Coco

- Hell or High Water

- The Farewell

- The Wind Rises

- The Martian

- Tinker Tailor Soldier Spy

- Star Wars: Episode VII – The Force Awakens

- Get Out

- Toy Story 4

- Black Swan

- Sound of Metal

- Dallas Buyers Club

- Black Panther

- Midnight in Paris

- 127 Hours

- The Big Short

- Sicario

- True Grit

- The Revenant

- Drive

- Zootopia

- The Wolf of Wall Street

- Bridge of Spies

- Masquerade

- Rush

- Weathering with You

- IMDb lists reflect an individual user’s preferences, which is why there’s occasionally a film you’ve never heard of. Still, this is probably better than just looking at the Oscar-nominated films from each year, which can include entries that don’t hold up. ↩